Beyond TurboTax: How AI Supersedes Rigid Software Logic with Flawless Interpretation

The Immense Complexity of the Tax Rulebook

Tax filing is a unique kind of problem: the scope is narrow—everything must conform strictly to tax law—but the complexity is immense. Every tax return, whether for an individual or a major corporation, must follow a dense and constantly shifting rulebook full of exceptions, thresholds, special cases, and cross-referenced regulations.

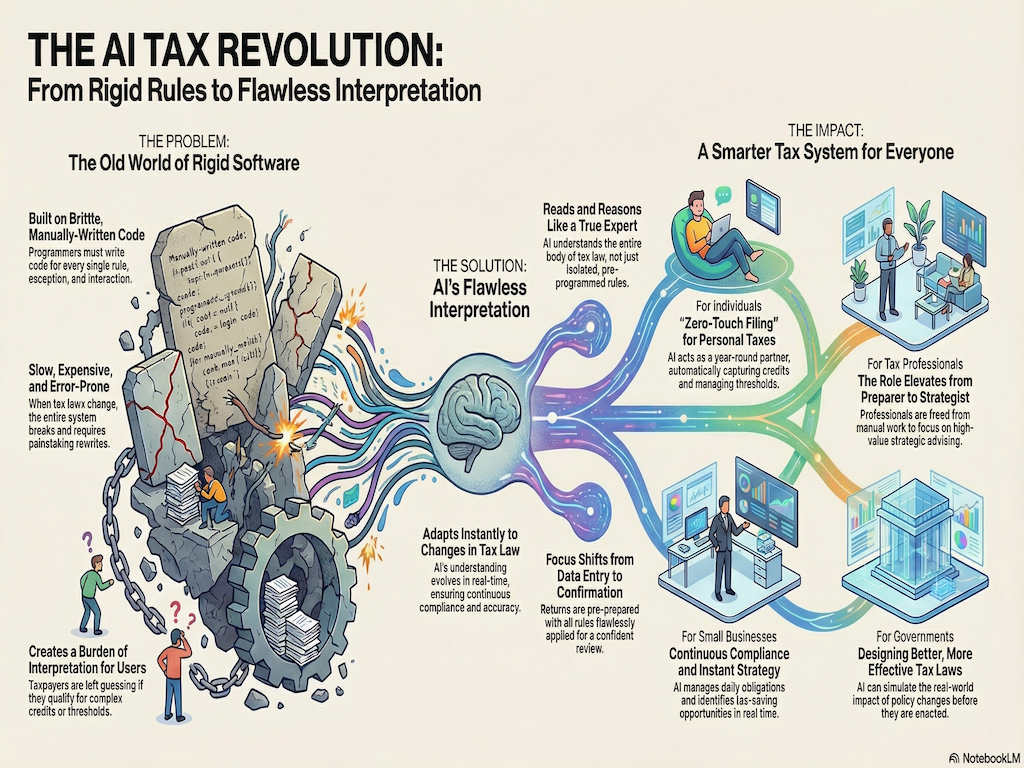

For decades, software like TurboTax solved the data entry problem, turning paper forms into digital checklists. But it couldn't solve the deeper problem of interpretation. Current software is built on rigid software logic, meaning programmers must manually write code for every rule, every exception, and every possible interaction. When tax law changes, this code breaks and must be painstakingly rewritten. This process is slow, expensive, and prone to bugs that cost taxpayers millions.

Artificial intelligence fundamentally changes this. AI doesn't rely on brittle code; it leverages its ability to read, interpret, and reason across the entire body of tax law, adapting instantly to updates. This transforms tax filing from a manual, error-prone burden into an intelligent, proactive system for everyone.

Individuals: The Shift from Annual Chore to Year-Round Strategy

For the personal taxpayer, the current system is a game of guessing and hoping. We spend a weekend hunting for deductions the software might miss, unsure if we qualify for a particular credit or if we crossed a phaseout threshold.

The difference AI brings is the establishment of Zero-Touch Filing. AI acts as a year-round, silent financial partner that completely reinvents the process by proactively capturing credits and automatically managing complex thresholds. It reads your real-time financial transactions, identifies qualifying expenses, and understands life events (like having a child or working remotely in a new state). For instance, if you pay for after-school care, AI instantly identifies the vendor, checks IRS criteria, and alerts you that you qualify for the Child and Dependent Care Credit months before tax season. Similarly, if you had student loan interest, tuition, or medical expenses, AI automatically evaluates all necessary income thresholds and phaseouts—something the old software forced you to figure out by answering question after question. Taxes become less about discovering what rules apply to you and more about confirming that AI has applied all the rules, flawlessly and completely, resulting in pre-prepared returns that only require a quick, confident confirmation.

Small Businesses: Mastering Confined Complexity

Small businesses operate inside a well-defined boundary (income, expenses, payroll) but face endless combinations of complex rules within it. This is where the rigidity of old software breaks down.

AI handles this complexity effortlessly, establishing Continuous Compliance and providing Instant Strategic Insight. For a café owner, AI tracks sales tax obligations across multiple jurisdictions, manages payroll filings, and categorizes expenses perfectly. It updates instantly when a law changes, keeping the business compliant every single day, not just at year-end. Beyond mere tracking, AI identifies critical tax opportunities, such as whether to use a Section 179 deduction for a new equipment purchase or which depreciation path offers the best advantage—all instantly, allowing the owner to focus on operations instead of bookkeeping.

The New Role of the Tax Professional: From Preparer to Strategist

The amazing improvements AI brings require a fundamental shift for CPAs and corporate tax teams, moving them away from manual work and toward high-value strategy.

For local CPAs serving small businesses, AI transforms the value proposition entirely. Instead of spending 80% of their time on manual data entry, reconciliation, and compliance checks, AI automates these tasks. This allows the CPA to move toward advisory, spending their time proactively identifying savings, and engaging in strategic planning. Similarly, for massive corporate tax departments, AI changes the scale and speed of global compliance. Where corporate teams once spent months reconciling thousands of complex cross-jurisdictional transactions for global reporting, AI now runs proactive scenarios in seconds to optimize global tax structures and minimize audit risk. In both cases, AI handles the massive scale, continuous monitoring, and flaw interpretation, allowing professionals to use their human expertise for judgment, strategic advising, and trust-building.

Government and Lawmaking: Designing Better Rules

The benefits of AI extend even to the creation of the rules themselves.

Tax law changes frequently, and each change affects millions of households and businesses differently—often with unintended consequences. AI allows governments to simulate real-world outcomes before a law is enacted. A proposed child tax credit expansion can be tested across millions of household profiles to ensure it works as intended and doesn't create unexpected loopholes or biases. A new modification can be stress-tested for edge cases and potential fraud. Lawmakers gain clarity, and the public benefits from clearer, more effective rules with fewer revisions.

The Future of Flawless Application

As AI advances, the annual tax burden will fade into the background. What the general public currently experiences—a slightly digitized paper form—is a fraction of AI's true potential.

Because tax law is a domain of confined complexity (bounded by specific rules but immensely intricate), AI's ability to constantly update, cross-check, and validate rules makes the system exponentially more reliable and accurate than any manual programming ever could. The result is a tax system that is more accurate, more transparent, and far easier to navigate for every individual and business. AI doesn't rewrite the rules; it simply applies them flawlessly.